Background

- On December 26, 2014, the Office of Management and Budget (OMB) published the Uniform Guidance: Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards in the Federal Register.

- Uniform Guidance, sometimes referred to as the “Supercircular” or “Omnicircular” provides a streamlined government-wide framework for grants administration and management that consolidates requirements from eight OMB Circulars.

- The Uniform Guidance was the result of years of collaboration between federal grant-making agencies, recipients, and other stakeholders from the grants community.

- The Uniform Guidance was the result of two presidential directives; Executive Order 13520 on Reducing Improper Payments, and the Presidential Memorandum on Administrative Flexibility, Lower Costs, and Better Results for State, Local, and Tribal Governments.

Purpose / Objective of the Uniform Guidance

The Uniform Guidance identifies the goals of grants reform as:

- Streamlining regulations to ease administrative burden; and

- Strengthening oversight of federal awards to reduce the risk of waste, fraud and abuse.

To meet these goals, the Uniform Guidance includes provisions to achieve the following policy reforms:

- Eliminate duplicative and conflicting guidance

- Increase accountability standards for non-federal entities

- Promote the efficient use of information technology

- Provide for the consistent and transparent treatment of costs

- Support key policy reforms surrounding allowable costs

- Strengthen oversight of federal awards

DOJ Adoption of OMB Uniform Guidance

In December 2014, the Department of Justice adopted the Uniform Guidance (2 C.F.R. Part 200) with some exceptions. The DOJ regulation is referred to as the Part 200 Uniform requirements. The exceptions were supplemented with additional guidance as described below.

- Equipment and Supplies

- DOJ adopted the OMB Uniform Guidance in 2 C.F.R. Part 200, except for 2 C.F.R. 200.313 and 2 C.F.R. 200.314, which are supplemented by the corresponding sections (e.g., §2800.313 supplements §200.313) of 2 C.F.R. Part 2800.

- Impact on OJP Award Recipient

- The exceptions supplemented by 2 C.F.R. 2800.313 and 2 C.F.R. 2800.314 are two specific changes to address property and equipment for the Edward Byrne Memorial Justice Assistance Grant Program (Byrne JAG).

- Byrne JAG recipients should pay particular attention to the guidance outlined in DOJ Grants Financial Guide, 3.7 Property Standards, Equipment and Supplies Acquired with Edward Byrne Memorial Justice Assistance Grant Program Funds.

Applicability of the Part 200 Uniform Requirements

As the Part 200 Uniform Requirements apply to a particular OJP award, the new regulation replaces ("supersedes") the following:

| Award date before December 26, 2014 | Award date after December 26, 2014 Award supplemented after December 26, 2014 |

|---|---|

| Guidance for Administrative Requirements and Cost Principles: 2 CRF 215 or OMB Circular A-110, 2 CFR 225, 2 CFR 220, or 2 CFR 230. In addition, for Non-profit grantees, 28 CFR part 70 and for State and Local government, 28 CFR part 66, as existed on the award date applies. | Guidance for Administrative Requirements and Cost Principles: Uniform Guidance (2 CFR 200) applies. |

| Existing terms and conditions of award agreements will continue | Uniform Guidance determines terms and conditions for new awards and funding increments to existing awards. For supplemental awards, the Uniform Guidance applies to the supplemental funding, and by award condition to all unobligated funding (including funding awarded before Dec. 26, 2014) on supplemented awards. |

OMB Circular A-133 guides audit requirements for fiscal years dated:

|

Uniform Guidance (2 CFR subpart F, Audit requirement) guides audit requirements for fiscal years dated:

|

| Indirect cost rates for non-Federal entities will remain in effect until they are re-negotiated. | Federal awarding agencies will use Uniform Guidance to renegotiate an indirect cost rate for a non-Federal entity for the fiscal year. |

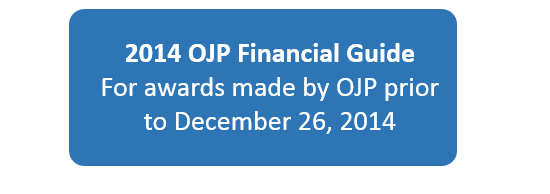

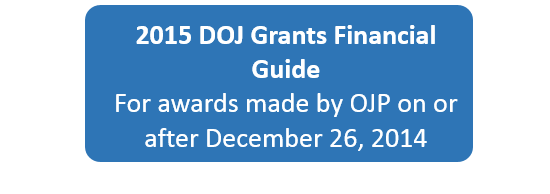

| The OJP Financial Guide, 2014 edition, will apply and will be kept available on the OJP website. | OJP issued a revised Financial guide, incorporating changes required by Uniform Guidance, in March 2015. For recipients of awards made after December 26, 2014 but before the issuance of a revised Financial Guide, the requirements of the Uniform Guidance supersede any directly conflicting portions of the existing OJP Financial Guide. |

Applicability of the Part 200 Uniform Requirements for OJP Awards

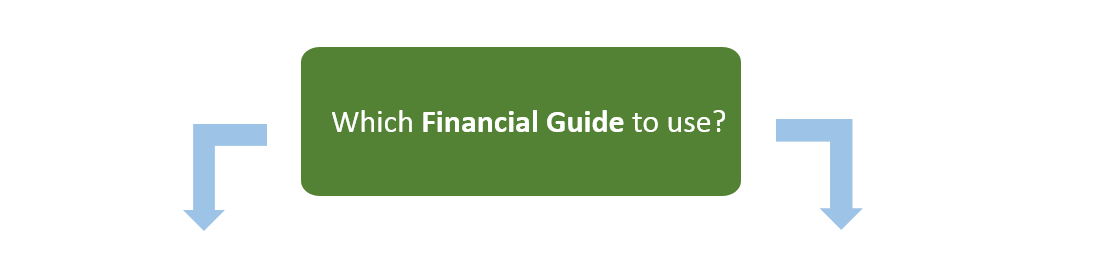

Because timing of an award impacts the applicability of the Part 200 Uniform Requirements, OJP has two different active versions of the Financial Guide for alignment with the award or supplement issuance date. The version that a recipient must use for an individual award depends on the date the award was made and the award terms and conditions—including conditions in any supplement to the initial award.

OJP's 2 CFR 200 Points of Emphasis

a. Grant Award Process

| Uniform Guidance | What This Means for an OJP Recipient |

|---|---|

| Awarding agencies are mandated to publish the selection criteria for awards in the notice of funding opportunity and to award all competitive grants and cooperative agreements on the established merit- based criteria (200.203 and 200.204) | There is no change for OJP award recipient. OJP already includes this information under the "Review Process" and "Selection Criteria" of its solicitations. |

| Agencies are required to conduct a pre-award risk assessment of all applicants before making an award (200.205) | OJP has implemented a pre-award risk assessment for all applicants, except individuals. OJP's process uses a variety of factors including financial capabilities and past performance, if applicable. |

| Standardized information included in the award notice, including the use of the Federal Award Identification Number (FAIN) and the relevant statutory and national policy requirements in the terms and conditions of the award (200.210 and 200.300) | There is no change for OJP award recipient. OJP already includes this information in its award packages. |

| Specific performance goals, indicators, milestones, and/or expected outcomes will be included in the terms and conditions for awards (200.210) | OJP has included as specific condition on each of its FY2015 awards (see special conditions language for respective awards). |

b. Grant Management

| Uniform Guidance | What This Means for an OJP Recipient |

|---|---|

| Recipients are required to provide information to the awarding entity demonstrating cost effective practices, such as unit cost data (200.301) | OJP asks grantees in their solicitations to demonstrate in their budget narratives how they will maximize cost effectiveness of grant expenditures. Budget narratives should generally describe cost effectiveness in relation to potential alternatives and the goals of the project |

| Interest earned on Federal advance payments deposited in interest-bearing accounts (200.305) | OJP updated the DOJ Grants Financial Guide (section 3.1) to reflect the new uniform guidance requirements on interest earned on Federal advance payments. Select the following link here. |

| Standardized the simplified acquisition threshold to $150,000 and tying all future increases to the FAR (200.318) | OJP updated the DOJ Grants Financial Guide (section 3.8) to reflect the new uniform guidance requirements on Federal Acquisition Regulation. Select the following link here. |

| Agencies are required to use only OMB-approved financial and performance reporting forms in order to standardize government-wide data elements (200.327 and 200.328) | There is no change for OJP award recipient. OJP already uses only OMB approved financial and performance forms. |

c. Pass-through Entities

| Uniform Guidance | What This Means for an OJP Recipient |

|---|---|

| Requiring pass-through entities to use the same data elements, including the FAIN, in the federal award notice in all subrecipient award documents (200.331) | There is no change for OJP award recipient. OJP already requires pass through entities to use the same data elements. |

| Pass-through entities are required to evaluate each subrecipient's risk of noncompliance with Federal statutes, regulations, and the terms and conditions of the subaward for purposes of determining the appropriate subrecipient monitoring (200.331) | OJP updated the DOJ Grants Financial Guide (section 3.14) to reflect the new uniform guidance requirements on subrecipient monitoring. Select the following link here. |

d. Record Retention

| Uniform Guidance | What This Means for an OJP Recipient |

|---|---|

| Retention requirements for records (200.333) | OJP updated the DOJ Grants Financial Guide (section 3.16) to reflect the new uniform guidance requirements on record retention. Select the following link here. |

e. Indirect Cost Rate

| Uniform Guidance Change | What This Means for an OJP Recipient |

|---|---|

| Agencies are required to accept the negotiated indirect cost rate for a recipient (200.414) | OJP updated the DOJ Grants Financial Guide (section 3.11) to reflect the new uniform guidance requirements on indirect cost rate. Select the following link here. |

| New recipients are provided the opportunity to indefinitely elect a de minimus indirect cost rate of 10% of Modified Total Direct Costs (200.414) | OJP updated the DOJ Grants Financial Guide (section 3.11) to reflect the new uniform guidance requirements on indirect cost rate. Select the following link here. |

| Entities are allowed to extend negotiated flat rates for up to four years (200.414) | OJP updated the DOJ Grants Financial Guide (section 3.11) to reflect the new uniform guidance requirements on indirect cost rate. Select the following link here. |

f. Audit Procedures

| Uniform Guidance Change | What This Means for an OJP Recipient |

|---|---|

| The single audit threshold is raised from $500,000 to $750,000 (200.501) | OJP updated the DOJ Grants Financial Guide (section 3.19) to reflect the new uniform guidance requirements on audit procedures. Select the following link here. |

g. Exceptions

| Uniform Guidance Change | What This Means for an OJP Recipient |

|---|---|

| (a) For classes of grants and grantees subject to this part, Federal agencies may not impose additional administrative requirements except in codified regulations published in the FEDERAL REGISTER. (b) Exceptions for classes of grants or grantees may be authorized only by OMB. (c) Exceptions on a case-by-case basis and for subgrantees may be authorized by the affected Federal agencies. (2 CFR 2800) | Previously referenced as 28 CFR Part 66 Uniform Administrative Requirements for Grants and Cooperative Agreements to State and Local Governments |

| OMB, after consultation with the Department's Division of Financial Management and Grants Administration may grant exceptions for classes of grants or recipients subject to the requirements of this part when exceptions are not prohibited by statute. However, in the interest of maximum uniformity, exceptions from the requirements of this part shall be permitted only in unusual circumstances. The Department shall apply more restrictive requirements to a class of recipients when approved by OMB. The Department may apply less restrictive requirements when awarding small awards, except for those requirements which are statutory. Exceptions on a case-by-case basis may also be made by Department. (2 CFR 2800) | Previously referenced as 28 CFR Part 70 Uniform Administrative Requirements for Grants and Cooperative Agreements (including Subawards) with Institutions of Higher Education, Hospitals and other Non-Profit Organizations |

Reference Documents

- Introduction to the Part 200 Uniform Requirements

- Subrecipient/Contract Toolkit

- Where to Find the Part 200 Uniform Requirements in the Code of Federal Regulations

- Quick Guide: Procurement Standards and the Part 200 Uniform Requirements (Forthcoming)

- OJP Quick Guide: Audit Requirements for OJP Awards under the Part 200 Uniform Requirements

- OJP Quick Guide: Indirect Cost Rates under the Part 200 Uniform Requirements

- Frequently Asked Questions for the Part 200 Uniform Requirements

- Essential Definitions